Should New Businesses in Japan Register for Consumption Tax?

【Koshida Accounting Firm Column Date:】

“Never test the depth of river with both the feet.” ― Warren Buffet

Hello, my name is Taisei Koshida, and I am a certified public accountant and tax accountant.

I aim to assist non-Japanese business owners who need help with reading or writing in Japanese. If you find the Japanese tax return system challenging, I can help you with your tax filings.

If you are wondering whether to register your business as an Invoice-registered business in Japan, the following blog will be helpful.

1. What Is a Consumption Tax?

A consumption tax is almost the same as a value-added tax you see all over the world.

You can find the blog I’ve included here if you’d like to see more details.

An Easy Explanation of Consumption Tax for Doing Business in Japan

2. When Are Businesses Taxed a Consumption Tax in Japan?

Businesses are taxed consumption tax when their taxed sales proceed 10 million yen. In detail speaking, businesses are subject to consumption tax starting two fiscal years later when businesses’ taxed annual sales proceed 10 million yen. Plus taxed sales proceed 10 million yen in the first half of the fiscal year, they are subject to consumption tax starting next fiscal year. The reason why the system is so was a consideration for small businesses.

3. The Refund of Consumption Tax

On the other hand, under Japanese consumption tax law, if your business spends a lot of costs and investments while sales are not enough, like in the first or second fiscal years, the payment of consumption tax is larger than the received consumption tax, your business can not refund consumption tax unless you have registered your business as a taxed business. This is a bad result of the government’s consideration.

Seeing the above, the government was initially considerate of small businesses. However, the Invoice System that started in October 2023 has changed everything.

4. After Introducing the Invoice System

This means taxed businesses can deduct paid consumption tax from received consumption tax only when payees register them as Invoice-registered businesses. Most companies supposedly believe they will lose money dealing with non-invoice-registered businesses. Therefore, you are most likely to be wanted to register your business as an Invoice-Registered business if you did not register. If you do not want to lose the possibility of getting sales at all, you may register for it.

You can find the blog I’ve included here if you’d like to see more details.

An Easy Explanation of Japan’s Invoice System

5. Simulations

(1) Cost and Investment Advance Business

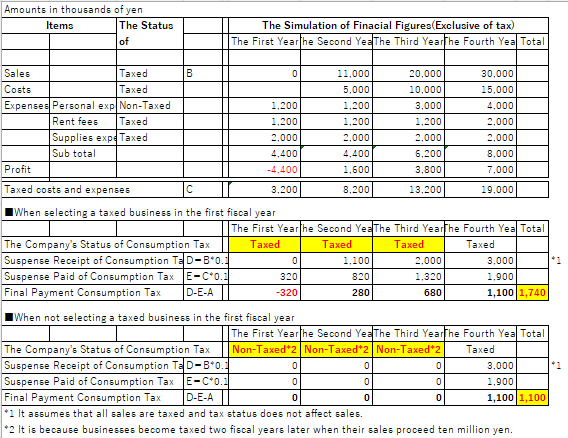

The simulation figures below are available. Indeed, it can be refunded in the first year by selecting taxed, but it is also subject to consumption tax in the second and third years. Therefore, in four years, the total consumption tax payment is more significant than non-taxed.

If your business initially needs a lot of money for an investment, selecting a taxed business may sometimes be advantageous.

More detailed information about this is in the following blog.

Consumption Tax on Real Estate Purchases by Private Lodging Businesses 民泊事業者が不動産物件を取得した際の消費税

(2) Non- Cost and Investment Advance Business

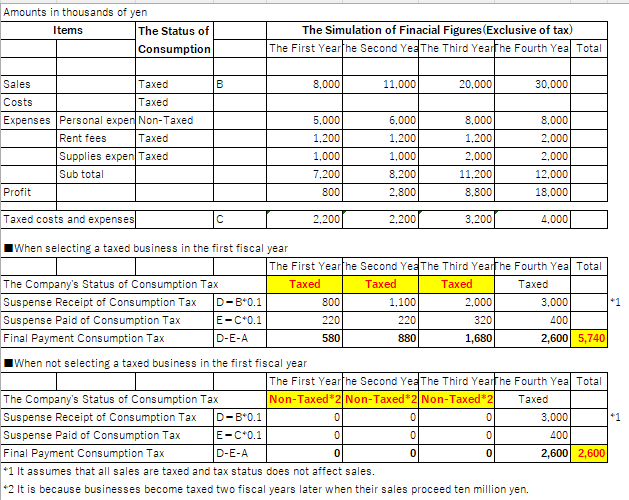

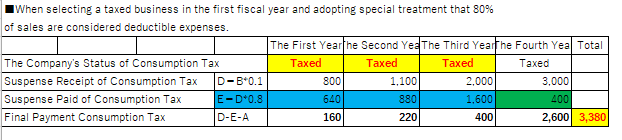

Selecting taxed businesses leads to payment of consumption tax, and in most cases, it means additional costs. But you can save these costs by adopting special treatment that 80% of sales are considered deductive expenses. It is only used when sales are at most 10 million yen.

You can see the above: the burden of consumption tax increases when selecting a taxed business, but you can adapt the special treatment and save consumption tax payment for a while. The simulation below is that.

Our accounting and tax office has been actively assisting foreign business owners in Japan with accounting and tax matters. Also, not only in the tax and accounting field, our office can support your business in Japan in the fields of visa, registration, social insurance, and law by networking with specialists. Plus, we have networked with specialists in web marketing, building websites, and business consulting suitable for Japanese customers. All services are provided in English. Please feel free to reach out to us through the inquiry form.