Under Japanese Tax Law, Director’s Compensations Must Be the Same Each Month

【Koshida Accounting Firm Column Date:】

Hi, my name is Taisei Koshida, and I am a certified public accountant and tax accountant.

I aim to assist non-Japanese business owners who need help with reading or writing in Japanese. If you find the Japanese tax return system challenging, I can help you with your tax filings.

If you are unclear about the director’s compensations in Japan, you might find this blog helpful.

Changes Within The First Three Months of The Fiscal Period Are Permitted

In Japan, corporations typically hold a general shareholders’ meeting approximately two months after the end of the fiscal year. At these meetings, shareholders approve the financial statements and determine the amount of the director’s compensation for the next period of executive duties.

However, small businesses typically determine this without holding shareholders’ meetings, because it’s often the case that the president is also the sole shareholder in these corporations. The period for executive duties extends from the day after the shareholders’ general meeting to the day of the next meeting. Therefore, under Japanese tax law, changes within the first three months of the fiscal period are permitted. The reason why it’s three months instead of two is because listed companies typically hold shareholders’ meetings about three months after the end of the fiscal year.

Typically, Executive Compensation Is Renewed from The Third Month of The Fiscal Year

In small businesses, the full-fledged operational period for executives begins three months after the fiscal year-end. Thus, the executive’s compensation for the third month is typically seen as the new amount. Therefore, if companies adjust the executive’s compensation, the changes are made starting from the third month.

Executive Compensation for The Current Month Is Paid Within The Same Month

It’s customary to pay the current month’s compensation within that same month.

If Director’s Compensations Are Not The Same

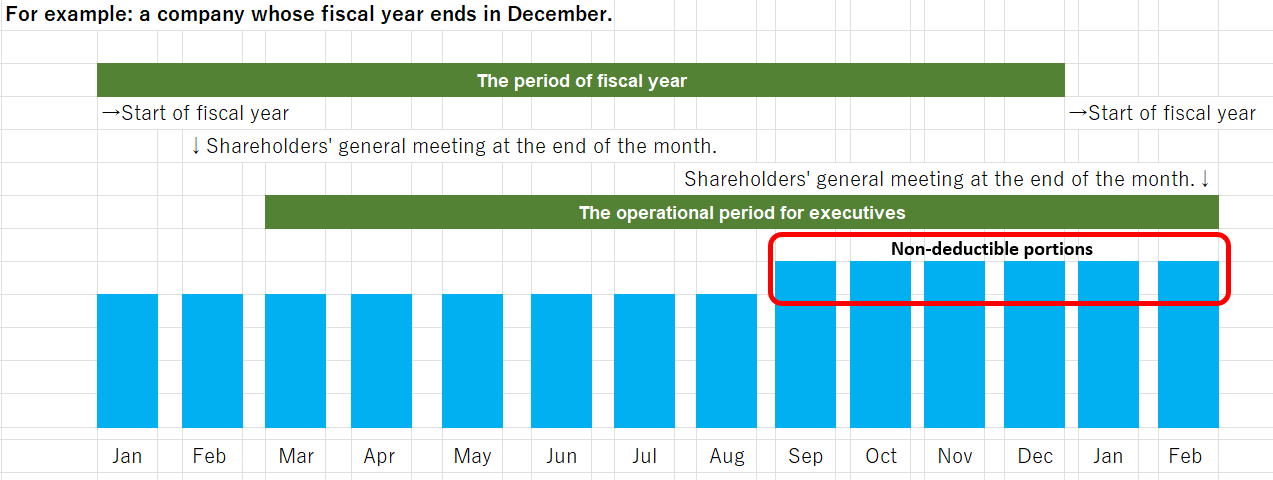

In cases where director’s compensations are increased after the fourth month of the fiscal period, the increased amount is not considered an expense under Japanese tax law. For instance, if a corporation, whose fiscal year ends in December, increased the director’s compensation by 300,000 yen per month from September, the total amount of 1,800,000 yen (300,000 yen x 6 months from September to Feburary ) is not recognized as an expense under Japanese tax law.

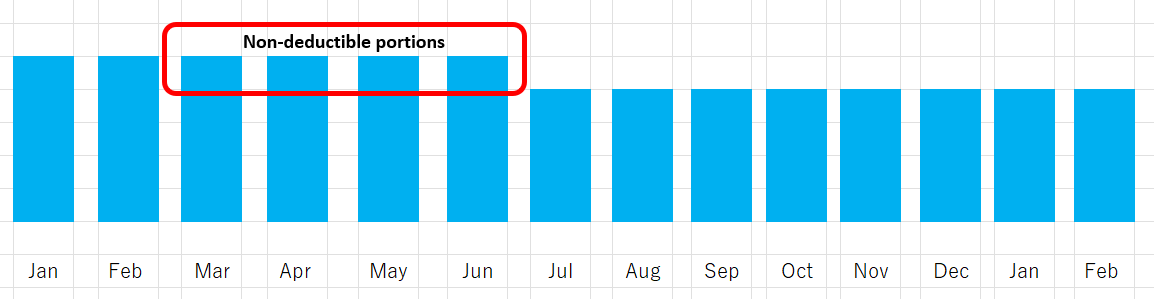

Similarly, when a director’s compensation is reduced, the difference between the pre-reduction and post-reduction amounts is not recognized as an expense under Japanese tax law. For example, if a company, which ends its fiscal year in December, decreases the director’s compensation by 300,000 yen per month from July, the total of 1.200,000 yen (300,000 yen x 4 months from March to June, counting from the fourth month after the start of the fiscal period) is not recognized as an expense under Japanese tax law. In other words, any excess portion is disallowed under tax law.

Our accounting firm has been actively assisting foreign business owners in Japan with accounting and tax matters. Please feel free to contact us through the inquiry form.