Consumption Tax on Real Estate Purchases by Private Lodging Businesses

【Koshida Accounting Firm Column Date:】

Hello, my name is Taisei Koshida, and I am a certified public accountant and tax accountant.

I aim to assist non-Japanese business owners who need help with reading or writing in Japanese. If you find the Japanese tax return system challenging, I can help you with your tax filings.

In private lodging businesses, sales are subject to consumption tax, leading to payable consumption taxes. But what about the consumption tax on purchasing properties?

民泊事業を行うと、売上は消費税の対象となる課税売上になり消費税が発生します。では、不動産購入に係る消費税はどのようになるのでしょうか?

To learn more about how consumption tax works, please refer to the following blog. 消費税の仕組みについては下記を参照してください。

An Easy Explanation of Consumption Tax for Doing Business in Japan

1.Purchasing Property from a Non-Business Individual 事業者でない個人から取得した場合

In this scenario, the purchase price itself is not subject to consumption tax, so it doesn’t include this tax. Consequently, there’s no provisional consumption tax that could be deducted from the payable tax to the tax office.

このケースでは、買価価額自体に消費税が掛かってこないため、買取価額には消費税が含まれません。そのため、当然ながら税務署に払う消費税から控除できる仮払消費税は発生しません。

2.Buying Property from Businesses, Including Real Estate Agencies不動産業者などの事業者から取得した場合

In this case, buildings are subject to consumption tax, resulting in the tax being applied. Conversely, land transactions are not taxed. You might assume that this could lead to a deduction from the consumption tax payable to the tax office, but it’s not that straightforward.

このケースでは、建物については消費税取引の対象になるので消費税が掛かってきます。一方で、土地は非課税取引になります。それならば、税務署に払う消費税から控除できる仮払消費税になるのかとも思えますが、すんなりそうはなりません。

(1)Typically, Self-Used Residential Properties Don’t Qualify for Provisional Consumption Tax Deduction 原則として自己使用の居住用物件は仮払消費税を控除できない

Real estate agencies that buy properties as inventory and resell them can deduct the consumption tax related to the property purchase from their sales-related consumption tax for the fiscal year. However, this isn’t the case for private lodging businesses using the property themselves.

不動産を在庫として仕入れて転売することを業とした不動産業者の場合は、物件購入に係る消費税を物件を購入した年度の仮払消費税として売上に係る消費税から控除できます。しかし、物件を自己で使用する民泊事業者はそうではありません。

(2)Deduction Eligibility in the Third Fiscal Year After Purchase 購入から3年目の事業年度で控除できる

However, there are cases where you can deduct a certain amount in the fiscal year that falls three years after the start of the fiscal year in which the property was purchased.

The consumption tax amount of the property purchase (①) × The total amount of taxed sales related to the property over three years (②) ÷ The total sales related to the property over three years (③)

The amount calculated using this formula can be deducted in the third fiscal year. For instance, if the property is not used for residential rentals and all revenue comes from taxable private lodging businesses, then the ratio of ② ÷ ③ becomes 100%. As a result, the entire amount of the property purchase consumption tax (①) can be deducted.

ただし、物件を購入した年度の期首日から3年経過する日の事業年度で一定額を控除できるケースもあります。 物件購入の消費税額(①)×物件についての3年間の課税売上の合計金額(②)÷物件についての3年間の売上高合計(③) この計算式で計算した金額を、3年目の決算の際に控除できます。そのため、例えばこの物件で居住用のアパートの賃貸などを全くしておらず、すべて課税取引となる民泊事業からの売上である場合には、上記式の②÷③が100%なるので、①の物件購入の消費税額が全額控除できることになります。

(3)Being a Taxed Business is Required for the Third-Year Deduction 3年目で控除を受けるには課税事業者であることが必要

If the business wasn’t a taxed entity in the fiscal year when the property was purchased, it’s ineligible for the third-year deduction. Therefore, for businesses in their first fiscal year, usually non-taxed, it’s necessary to voluntarily opt for taxed status and submit a notification of choosing to be a taxed business by the end of that first fiscal year.

購入した年度に課税事業者でなければ3年目での控除を受けることができません。そのため、法人設立初年度などの場合は通常は免税事業者なので、自ら課税事業者を選択する旨の課税事業者選択届を初年度の末日までに提出しておく必要があります。

(4)The Necessity of Simulations シミュレーションが必要

However, you won’t know which option is more advantageous until you compare the cash flow of becoming a taxed business, including possible refunds, with the cash flow of remaining a non-taxed business.

ただし、課税事業者になって受けることができる還付を含めたキャッシュフローと、免税事業者のままでいる場合のキャッシュフローを比較しないと、どちらが有利かはわかりません。

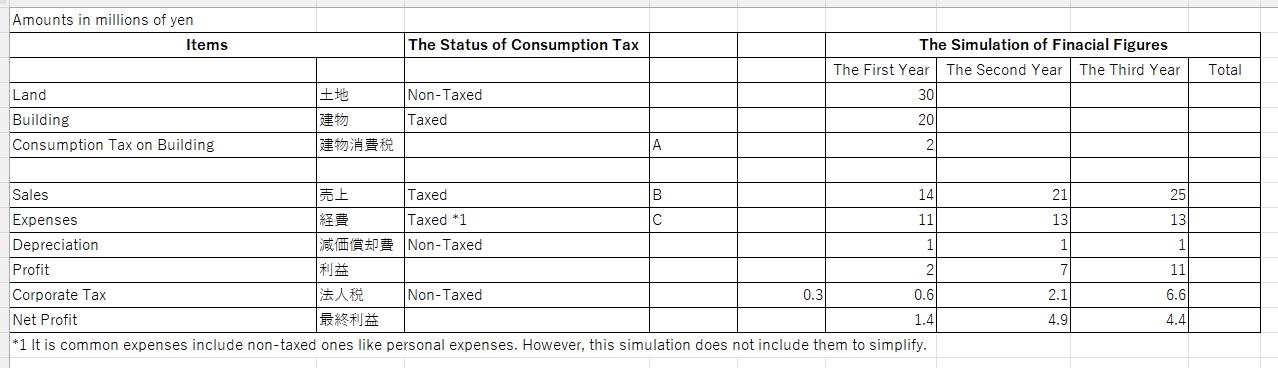

Below is a simplified simulation data. 下記は単純化した試算データです。

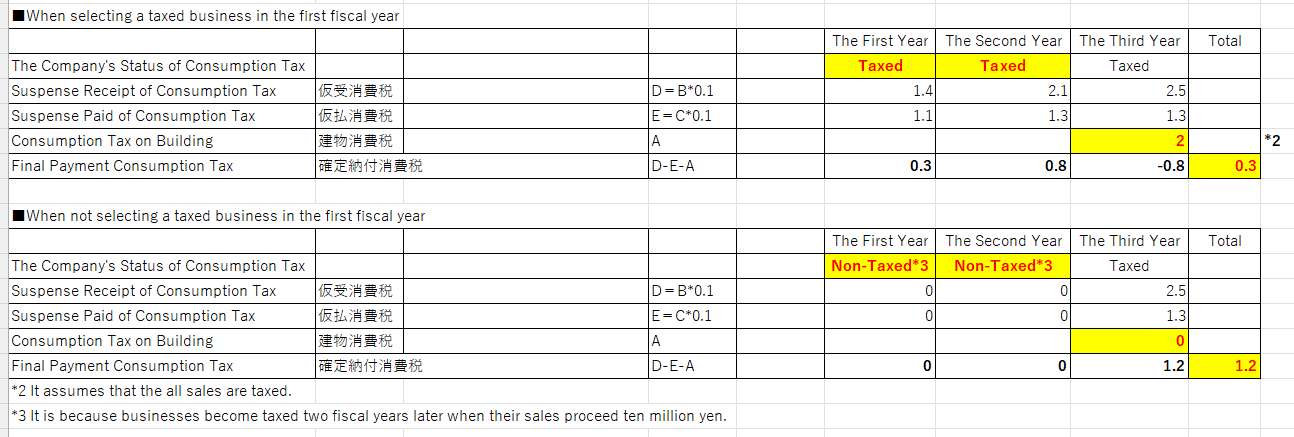

Next, we compare the scenario of choosing to be a taxed business from the first year with not choosing it.

そして、初年度から課税事業者を選択した場合と選択しない場合とを比較します。  As shown above, the total consumption tax over three years amounts to 0.3 million yen when opting for taxed business status, compared to 1.2 million yen if not chosen. Therefore, the former scenario is more advantageous.

As shown above, the total consumption tax over three years amounts to 0.3 million yen when opting for taxed business status, compared to 1.2 million yen if not chosen. Therefore, the former scenario is more advantageous.

上記のように、3年間の消費税の合計額は、選択した場合は0.3百万円、選択しなかった場合は1.2百万円ですので、前者のほうが有利な結果となります。

Our accounting and tax office has been actively assisting foreign business owners in Japan with accounting and tax matters. Also, not only in the tax and accounting field, our office can support your business in Japan in the fields of visa, registration, social insurance, and law by networking with specialists. Plus, we have networked with specialists in web marketing, building websites, and business consulting suitable for Japanese customers. All services are provided in English. Please feel free to reach out to us through the inquiry form.